- Forums

- :

- Core Technology - Magento 2

- :

- Magento 2.x Programming Questions

- :

- EU tax configuration

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

EU tax configuration

SOLVED- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,

can please someone help me to setting up correct tax settings:

I import the correct EU tax rates from here:

https://github.com/yireo/Magento_EU_Tax_Rates

my Store:

country: Austria

My shop is for B2C and B2B.

- Customer is domestic:

- Products Endcustomer: 20%

- Products Company (B2B): 20%

- Working Hours Endcustomer: 20%

- Working HoursCompany (B2B): 20%

- Downloadable Medias Endcustomer: 20%

- Downloadable Medias Company (B2B): 20%

- Customer is from EU (Germany, Italy, ...)

- Products Endcustomer: 20%

- Products Company (B2B): 0%

- Working HoursEndcustomer: 20%

- Working HoursCompany (B2B): 0%

- Downloadable Medias Endcustomer: 20%

- Downloadable Medias Company (B2B): 0%

- Customer is not from EU

- Products Endcustomer: 0%

- Products Company (B2B): 0%

- Working HoursEndcustomer: 0%

- Working HoursCompany (B2B): 0%

- Downloadable Medias Endcustomer: 0%

- Digitale Medien Company (B2B): 0%

How did I have to set the correct settings? As far I read all information I found, i seems I have to setup the tax for each country ... this is crazy :-)

Thank you!

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Meetanshi

Thank you .. but work not like I need:

My Shop is from Austria and a B2C Customer buying from Germany:

So he has to add 20% (Austrian Tax)

To get his, I need to do:

- Tax Zone and Rates

- Change "Germany (standard)" from 19% to 20% (I need this with all EU countries)

- Tax Rules:

- add rule Tax class "0%"

- Add all "zero" EU Tax zones (0%)

- add rule Tax class: "20%"

- Add all "standard" EU Tax Zones (20%)

- add rule Tax class "0%"

- Customer groups:

- add group "EU B2C" with tax class "20%"

- add group "EU B2B" with tax class "0%"

- add group "Domestic B2C" with tax class "20%"

- add group "Domestic B2B" with tax class "20%"

- add group "non EU B2C" with tax class "0%"

- add group "non EU B2B" with tax class "0%"

- Customer:

- put customer in group "EU B2C"

Then a B2C customer get 20% tax

When I put the customer in the customer group "EU B2B" he get 0% tax

Is this way correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Hello @hanhoe

You are on the right track. Uptill now, your settings are correct. The only thing you have to do now is assign tax class to the product.

If you have any doubts further, please mention it and I'll try to help you out.

Thanks.

If you've found my answer useful, please give"Kudos" and "Accept as Solution"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Hi @Meetanshi

Thank you!

But how I set up the customer?

Did I need to set an own customer group for B2B and B2C?

B2B: no or no valid VAT

B2C: valid VAT

So how Magento 2 work with the VAT info? Did I have to deal the VAT valid for my own?

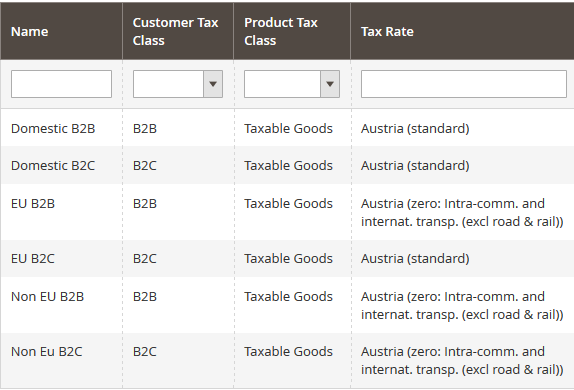

I set up the following tax rules:

When a customer is "EU B2C" he should calc 0% (set in the Tax Rate)

When a customer is "EU B2B" he should calc 20%

When a customer is "Non EU B2B" he should calc 0%

When a customer is "Domestic B2C" he should calc 20%

But how set the customer to the right Tax Rule?

When I has to use "Customer Tax Class" then I need also 6 customer groups, according to the Tax rules and put each customer in the correct customer group.

But I want that Magento do this by its own, based on Country and VAT

Is this not possible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Hi @hanhoe

First, create Customer Tax Class when creating new tax rule under "Additional Settings" as shown here:

- Go to Customer > Customer Groups

https://meetanshi.d.pr/h7bI84 - Edit the customer group that you want to assign tax class as shown here:

https://meetanshi.d.pr/ZXamCU

Hope it helps.

If you've found my answer useful, please give"Kudos" and "Accept as Solution"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi @Meetanshi

Thank you .. but work not like I need:

My Shop is from Austria and a B2C Customer buying from Germany:

So he has to add 20% (Austrian Tax)

To get his, I need to do:

- Tax Zone and Rates

- Change "Germany (standard)" from 19% to 20% (I need this with all EU countries)

- Tax Rules:

- add rule Tax class "0%"

- Add all "zero" EU Tax zones (0%)

- add rule Tax class: "20%"

- Add all "standard" EU Tax Zones (20%)

- add rule Tax class "0%"

- Customer groups:

- add group "EU B2C" with tax class "20%"

- add group "EU B2B" with tax class "0%"

- add group "Domestic B2C" with tax class "20%"

- add group "Domestic B2B" with tax class "20%"

- add group "non EU B2C" with tax class "0%"

- add group "non EU B2B" with tax class "0%"

- Customer:

- put customer in group "EU B2C"

Then a B2C customer get 20% tax

When I put the customer in the customer group "EU B2B" he get 0% tax

Is this way correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Hi @hanhoe

To check if the output is correct or not can only be verified after testing.

Thanks.

If you've found my answer useful, please give"Kudos" and "Accept as Solution"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Yes, but I´m little wonder that no one other use this.

And there is a bug:

When I´m at checkout and change my billing address and add a VATand save, he still show the TAX ... I have again to set change and just click refresh .. then he use no TAX.

Seems with the automatic set user group based on VAT are not working correct.

I test all countries by my own and also if he put because of the VAT the correct tax.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EU tax configuration

Did you found a solution to fix this issue?