- Forums

- :

- Core Technology - Magento 1.x

- :

- Magento 1.x Admin & Configuration Questions

- :

- Re: Magento can't calculate 8% VAT

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Magento can't calculate 8% VAT

SOLVED- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello,

I work in Switzerland with Magento 1.9.2.1 and I need to set VAT to 8% BUT....

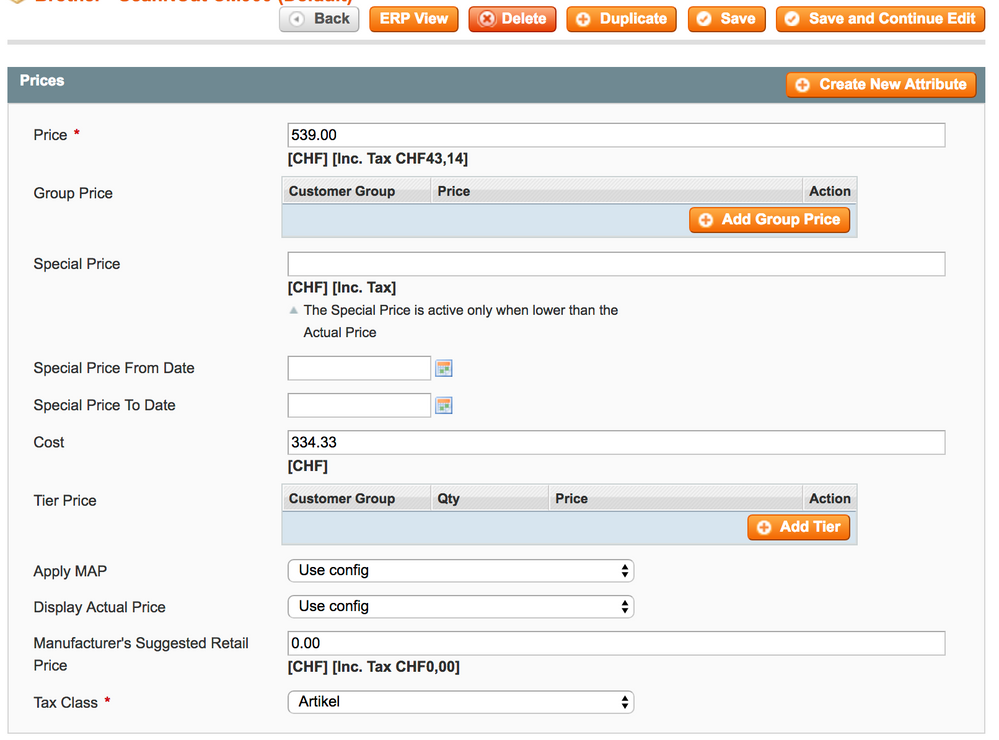

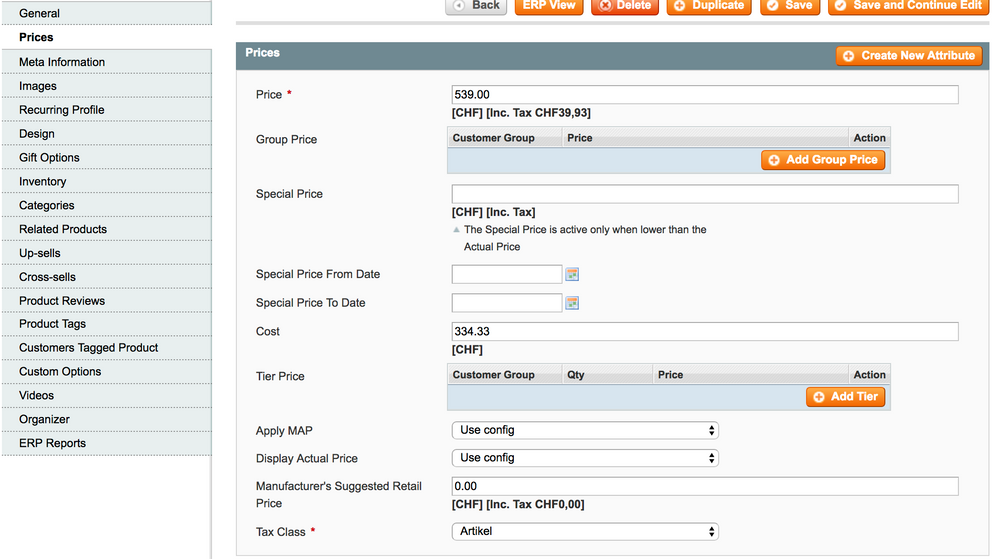

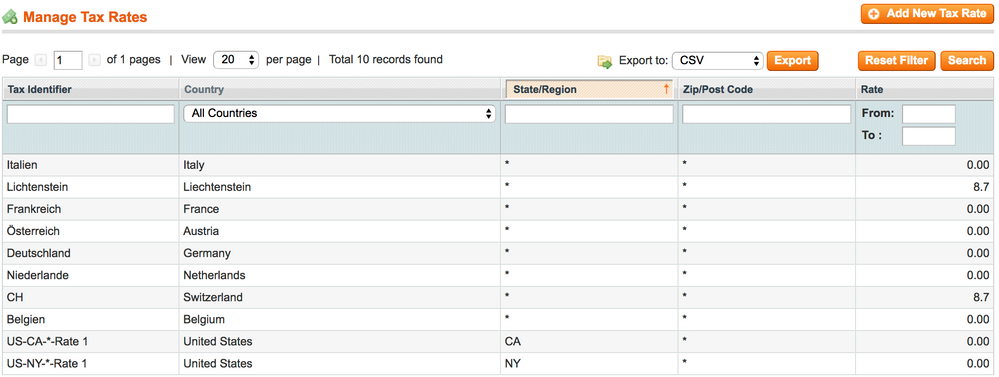

...If I Add in Sales>Tax>Manage>Tax Zones & Rates 8% VAT, magento calculates 7.4%! (To see here: Catalog>Manage Products choose any Product >Prices Please see Screenshots).

Workaround: Change value to 8.7% so it will display 8% VAT.

But I need a real solution for this case.

Btw. I am only user please talk/write to me as if you talk to a child... Thanks! ;-)

I did not find a solution for this case in any Forum, so please don't tell me to google this matter...

Thanks a lot in advance! Tom.

8.7% (actually 8.7% is CHF 46.893.- NOT CHF 43.14)

8% (actually, is CHF 43.12 NOT 39.93)

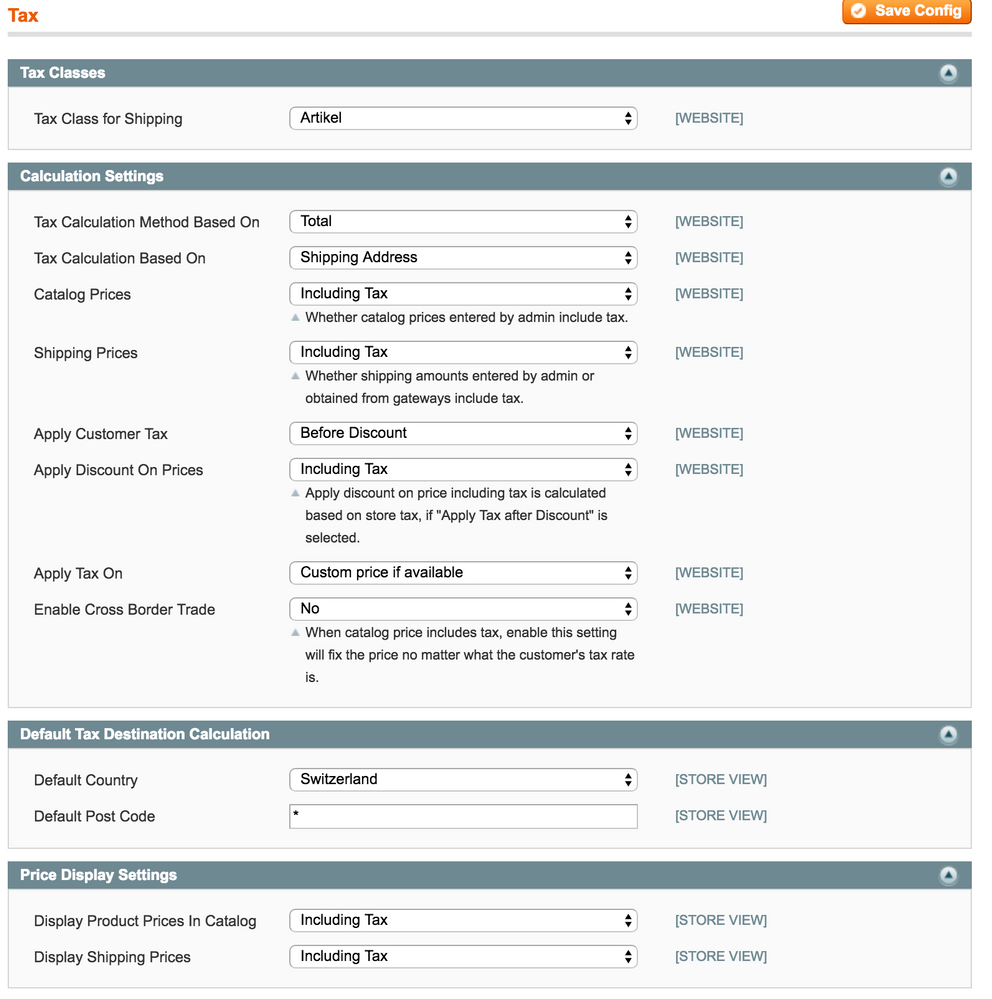

More Screenshots, that might help to find the problem.

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi there. I think you've made a mistake in your calculations of what 8% tax would be. It looks like your Magento is configured for the prices that you enter into admin to be assumed that they already include tax, i.e. 539 is the inc tax price. To calculate the excl tax price (and hence the amount of tax that's been applied), Magento needs to calculate what excl tax price, when 8% is added on, comes to 539.

The maths to do this is:

539 / 1.08 = 499.074

The amount of tax applied is 539 - 499.074 which equals 39.93. The tax that magento correctly. shows.

To validate this, we can go the other way we consider what is 108% of the excl tax price

499.074 * 1.08 = 539.

This comes down to the fact that to calculate what 8% tax is, you can't take 92% of the inc tax price. As this is a calculate based on the excl tax + tax price. You instead have to reverse the exact process by which you added tax.

I hope that made some sense! I'm not sure I explained it very well!

If you've found one of my answers useful, please give "Kudos" or "Accept as Solution" as appropriate. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, maybe I didn't explain myself very well but my previous response was explaining why Magento actually is calculating 8% tax properly. So if your prices that you've put into admin do indeed already include tax, then the setting the tax rate to 8% is the correct thing to do and Magento is calculating the tax accurately. So there's nothing to be done other than to change the tax rate back from 8.7% to 8%.

If you've found one of my answers useful, please give "Kudos" or "Accept as Solution" as appropriate. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi there. I think you've made a mistake in your calculations of what 8% tax would be. It looks like your Magento is configured for the prices that you enter into admin to be assumed that they already include tax, i.e. 539 is the inc tax price. To calculate the excl tax price (and hence the amount of tax that's been applied), Magento needs to calculate what excl tax price, when 8% is added on, comes to 539.

The maths to do this is:

539 / 1.08 = 499.074

The amount of tax applied is 539 - 499.074 which equals 39.93. The tax that magento correctly. shows.

To validate this, we can go the other way we consider what is 108% of the excl tax price

499.074 * 1.08 = 539.

This comes down to the fact that to calculate what 8% tax is, you can't take 92% of the inc tax price. As this is a calculate based on the excl tax + tax price. You instead have to reverse the exact process by which you added tax.

I hope that made some sense! I'm not sure I explained it very well!

If you've found one of my answers useful, please give "Kudos" or "Accept as Solution" as appropriate. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Magento can't calculate 8% VAT

Hello Tom,

Thank you so much for your answer and explaining, I understand the problem.

Can you tell me how to solve it?

Thanks again!

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, maybe I didn't explain myself very well but my previous response was explaining why Magento actually is calculating 8% tax properly. So if your prices that you've put into admin do indeed already include tax, then the setting the tax rate to 8% is the correct thing to do and Magento is calculating the tax accurately. So there's nothing to be done other than to change the tax rate back from 8.7% to 8%.

If you've found one of my answers useful, please give "Kudos" or "Accept as Solution" as appropriate. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Magento can't calculate 8% VAT

You are right, I am sooo dumb! I understand now!.. lol ![]()