- Forums

- :

- Core Technology - Magento 2

- :

- Magento 2.x Admin & Configuration Questions

- :

- Re: Help with formatting CSV for New York State Ta...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Help with formatting CSV for New York State Tax Rate import

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with formatting CSV for New York State Tax Rate import

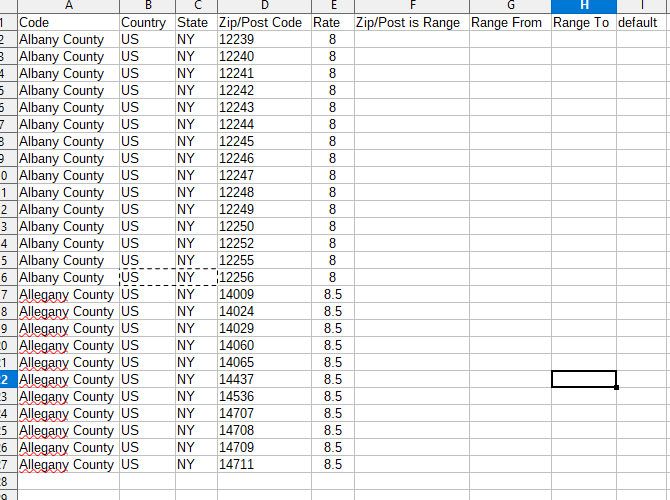

I'm in the process of setting up a Magento CE 2 store. We are based in New York and have to charge sales tax by shipping destination county. I've got a spreadsheet by individual zip code with the tax rates. Would formatting the import sheet as shown in the attached photo be the correct way to do it? Do I need to set up a separate tax rule for each county?

It doesn't look like the board wants to take my photo. My layout is as follows:

| Code | Country | State | Zip/Post Code | Rate | Zip/Post is Range | Range From | Range To | default |

| Albany County | US | NY | 12239 | 8 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with formatting CSV for New York State Tax Rate import

Hi @jcristaldi471e

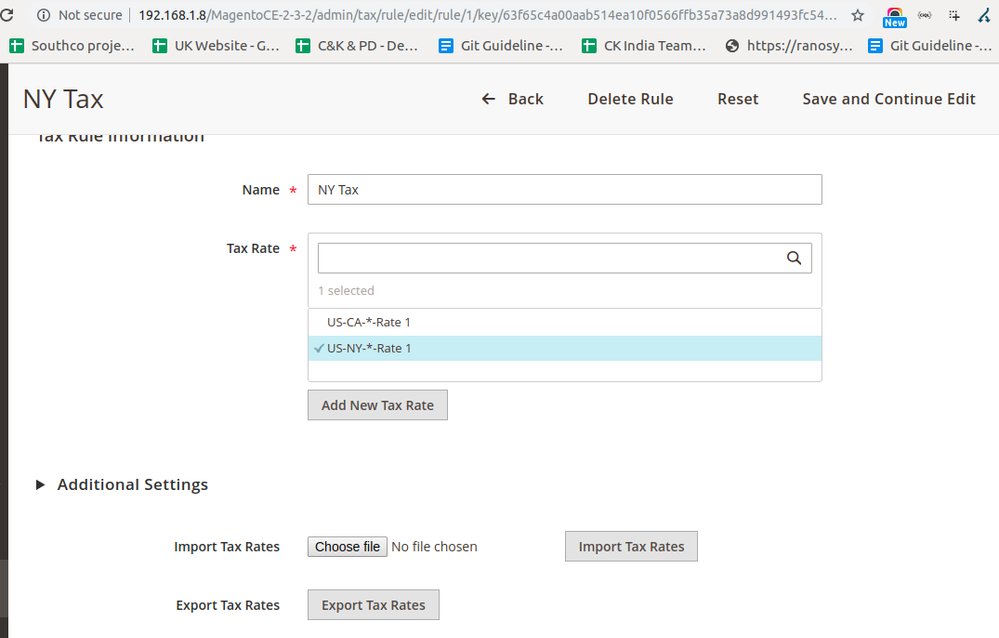

I have upload CSV for new taxes according to country and state:

Code Country State Zip/Post Code Rate Zip/Post is Range Range From Range To default US-CA-*-Rate 1 US CA * 8.25 US-NY-*-Rate 1 US NY * 10

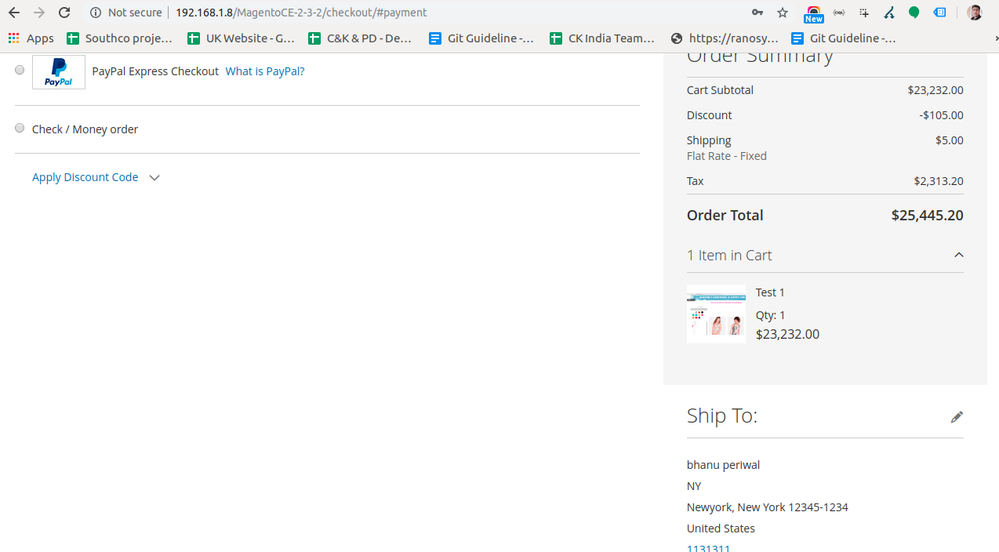

But with Magento we need to create tax rule using these tax rates. Then tax can be applied for order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with formatting CSV for New York State Tax Rate import

Perhaps let me clarify my questions. In New York state, sales tax is different for each county in the state. County location is determined by zip code. The zip codes do not necessarily go in series. There are approximately 2300 different zip codes in New York.

My questions are as follows:

- Can I use the same "Code" name for multiple zip codes because they are in the same county on my import csv? So I could use the County name for the code, or should i use the Zip Code for the "Code" name?

- Can I make a Tax Rule for just the County or do I have to do a separate tax rule for each Zip Code?

I would think of all the Magento users, someone has set up a store to collect sales tax in New York. I'm looking for advice on the best way to achieve this. We could use a plugin like TaxJar, but since we only collect tax in one state, and a very small amount at that, it does not seem worth the extra fees if it can be done by simply setting up the right tax rules in Magento.

Thank you in advance for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with formatting CSV for New York State Tax Rate import

We considered doing this ourselves - we're primarily concerned only for California - and thought about the idea of compiling the list of counties, etc, most of which were already in our QuickBooks system.

Problem is, the tax rates could change for any county/zip each year (and the effective date in the year could be different), and myriad other issues that you've probably already thought of. We decided to look around and went with a great vendor that takes a small fee for each transaction only for the state we do business in. If we expand to other states of tax liability, they can accommodate - state by state. Not sure if it's appropriate to mention the vendor here, but we were very happy with their response time, support, and accuracy.

IM me if you'd like the name.